Link PAN Card to Aadhar 2022: Aadhar card consists of a unique 12 digit number issued by the Unique Identification Authority of India (UIDAI) to every citizen in India. It acts as an identification number that helps in accessing cardholder details, such as biometrics and contact information, from government databases. Any person, irrespective of age and gender, being a resident of India, can voluntarily enrol for obtaining an Aadhaar number. The enrollment process is free. Once a person is enrolled, their details get permanently stored in the database. A person cannot have multiple Aadhaar numbers.

If you have a PAN and are eligible to get Aadhaar or already have an Aadhaar number, you need to inform the Income Tax Department. You can do this by linking PAN with Aadhaar. If you fail to do PAN-Aadhaar linking, your PAN will become ‘inactive’.

Contents

In Hindi:

आधार कार्ड में भारत के प्रत्येक नागरिक को भारतीय विशिष्ट पहचान प्राधिकरण (यूआईडीएआई) द्वारा जारी एक अद्वितीय 12 अंकों की संख्या होती है। यह एक पहचान संख्या के रूप में कार्य करता है जो सरकारी डेटाबेस से कार्डधारक विवरण, जैसे बायोमेट्रिक्स और संपर्क जानकारी तक पहुंचने में मदद करता है। कोई भी व्यक्ति, चाहे वह किसी भी उम्र और लिंग का हो, भारत का निवासी होने के नाते, आधार संख्या प्राप्त करने के लिए स्वेच्छा से नामांकन कर सकता है। नामांकन प्रक्रिया नि:शुल्क है। एक बार जब कोई व्यक्ति नामांकित हो जाता है, तो उनका विवरण डेटाबेस में स्थायी रूप से संग्रहीत हो जाता है। एक व्यक्ति के पास कई आधार नंबर नहीं हो सकते हैं।

यदि आपके पास पैन है और आधार प्राप्त करने के योग्य हैं या पहले से ही आधार संख्या है, तो आपको आयकर विभाग को सूचित करना होगा। आप पैन को आधार से लिंक करके ऐसा कर सकते हैं। यदि आप पैन-आधार लिंकिंग करने में विफल रहते हैं, तो आपका पैन ‘निष्क्रिय’ हो जाएगा।

Why link aadhar with a pan card?

An income tax return can be e-filed without linking of Aadhaar and PAN till August 5, 2017, said the notification of the Income Tax Department. However, the deadline for linking PAN with Aadhaar was extended till December 31, 2017, and after that, the due date was extended. many times. As per the latest update, the deadline for linking PAN with Aadhaar was March 31, 2022.

Note that if you file an income tax return without linking, the income tax department will not process the return until PAN and Aadhaar are linked. So people can visit the official e-filing website of the department to link the two identities in both cases- the same name in the two databases or in a case where there is a slight mismatch.

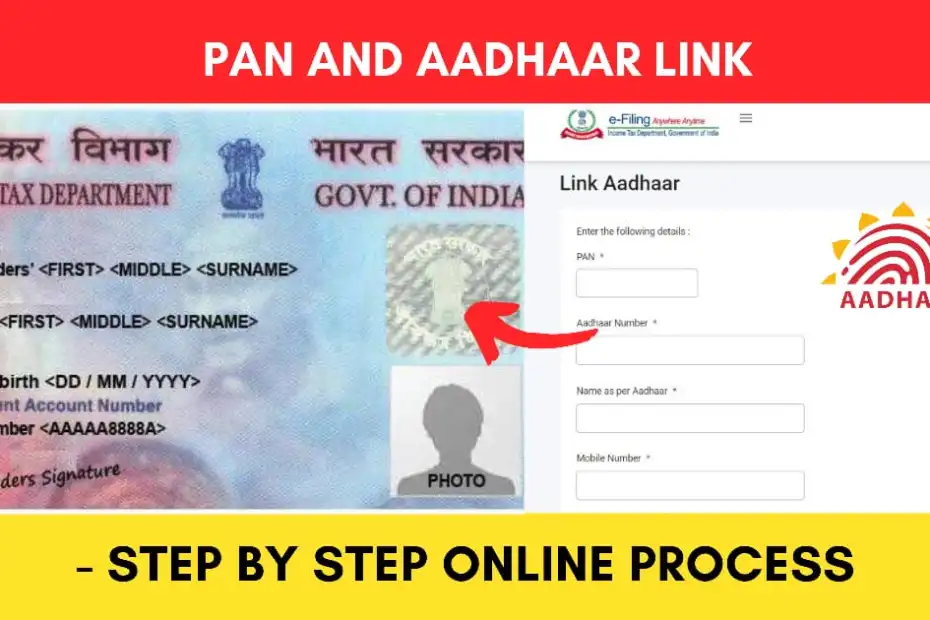

Aadhar number and PAN linking online

You can link your Aadhaar number with your PAN online by logging into the Income Tax e-filing portal. There are two ways to do this on the Income Tax Portal.

- Without logging in to your account

- Logging in to your account

Without logging into your account

- Go to www.incometax.gov.in. On scrolling down the home page, click on the ‘Our Services’ tab.

Income tax portal home page image - Enter the following details:

- PAN

- Aadhar Number

- Name accurately specified on Aadhar card (Avoid spelling mistakes)

- Mobile Number

- If only the year of birth is mentioned in your Aadhar card, then select the check box asking “I have only the year of birth on your Aadhar card”. Tick the box that says “I agree to validate my Aadhaar details”. It is mandatory to select this check box to proceed with Aadhaar linking. Select continue.

You will receive a 6 digit one-time password on your mobile number. - Enter this OTP on the verification page on your screen. Once you have entered the OTP, click on the ‘Validate’ button.

Also, Read- How to Add Mobile Number in Aadhar Card, How to Link Mobile Number To Aadhar Card, Importance of Linking

Logging into your account

- If you are not already registered, register yourself on the Income Tax e-filing portal.

- Then log in to the e-filing portal of the Income Tax Department by entering the User ID.

- Confirm your secure access message and enter a password. And click ‘Continue’ to proceed.

- After logging in to the website, click on ‘Link Aadhaar’. Alternatively, go to ‘My Profile and select ‘Link Aadhaar’ under the ‘Personal Details’ option

- Now enter details like name, date of birth and gender

- The details furnished at the time of registration on the e-filing portal will be as already mentioned. Enter Aadhar Number and Name as per Aadhar. Verify the details on the screen with the details mentioned in your Aadhar card.

- So it is mandatory to give your consent by selecting the check box ‘I agree to validate my Aadhaar details’.

- If only the year of birth is mentioned in your Aadhar card, select the check box asking ‘I have only the year of birth on your Aadhar card’.

- Then click on the ‘Link Aadhaar’ button.

- A pop-up message will inform you that your Aadhaar number has been successfully linked with your PAN card.

Useful Links:

NSP Registration 2022, Number Tracking Online, PMO Full Form, CPCT Typing Test English, PMG Disha, E-Aadhar UIDAI Download, NSP Registration 2022, Aaj Tak Reporter Contact Number.

Linking of Aadhaar Number and PAN via SMS

Now you can link your Aadhaar and PAN through SMS also. So the income tax department has urged taxpayers to link their Aadhaar with their PAN, using an SMS-based facility. It can be done by sending an SMS to either 567678 or 56161. Send SMS to 567678 or 56161 from your registered mobile number in the following format:

UIDPAN<12 digit Aadhaar><10 digit PAN>

Example: UIDPAN 123456789123 AKPLM2124M

What happens if PAN becomes inactive?

When your PAN becomes inoperative, it is assumed that PAN has not been submitted as per law. However, if you use your PAN card as identity proof for purposes not related to tax such as opening a bank account, applying for a driving license, etc., the penalty should not be imposed.

Once you have linked your PAN and Aadhaar, PAN is activated, and no penalty will be applicable after the date of linking. People with inactive PAN cards must remember that they need not apply again for a new PAN card as once linked the PAN card becomes valid once again.

Also, Read- E Aadhar UIDAI Download, Download E-Aadhar from DigiLocker, Things to remember while downloading… Read More

How to check if your PAN and Aadhaar are linked?

Follow these simple steps to check the status of linking

- Visit www.incometaxindiaefiling.gov.in/aadhaarstatus

- Enter PAN and Aadhaar Number

- Click on ‘View Link Aadhaar Status’

- The status of the linking is displayed on the next screen

Useful Links:

NSP Status Check, Mobile Number Location Live, TPA Full Form, Mangal Typing Test, DBT Agriculture Bihar, Aadhar Card Status Check, National Scholarship Last Date, Customer Care Number of Uninor.

FAQs on Link PAN Card to Aadhar 2022

While trying to link PAN-Aadhaar, I get a message that authentication failed?

Authentication fails due to a mismatch in data between your PAN and Aadhaar. You can check the correctness of the data like name, date of birth, mobile number etc.

Can I file my ITR if my PAN and Aadhaar are not linked?

For filing an income tax return, you need to provide your Aadhaar number. So in the absence of an Aadhaar number, you will have to mention your Aadhaar Enrollment Number.

Does a Non-Resident Indian (NRI) need to link PAN and Aadhaar?

Can get an Aadhaar number only as a resident Indian. Therefore an individual who has been in India for 182 days or more in the preceding 12 months, is a resident immediately preceding the date of Aadhaar application. An NRI need not obtain Aadhaar and link his PAN with Aadhaar.

What is the last date for linking PAN with Aadhaar?

Essentially, the deadline to keep your PAN operative without linking your Aadhaar has been extended to March 31, 2023, from the previous deadline of March 31, 2022. However, from April 1, 2022, you will have to spend on PAN-Aadhaar linking pennies.

Also, Read- Aadhar Card Mobile Number 2022, How to change Mobile Number Online/Offline, FAQs… Read More

Do I need to submit any documentary proof to link my PAN and Aadhar cards?

No, you do not need to submit any documents while linking your Aadhaar with your PAN card. You have to check whether the PAN information mentioned on the website matches with your Aadhar card and then apply to link them.

Can I link Aadhaar with PAN now?

- Log in by entering the User ID, password and date of birth.

- A pop-up window will appear, prompting you to link your PAN with Aadhaar.

- If not, go to ‘Profile Settings’ on the Menu bar and click on ‘Link Aadhaar’. Details such as name date of birth and gender will already be mentioned as per the PAN details.